China’s NEV industry opening wider arms to battery swapping model

Date:2019-10-09Source:Views:

To cut greenhouse gas emissions generated by transportation area, battery electric vehicles (BEVs) have been recognized as a good option towards the ultimate goal of zero-emission. However, the restricted range, the extended recharging time and insufficient charging facilities discourage a number of consumers from buying BEVs.

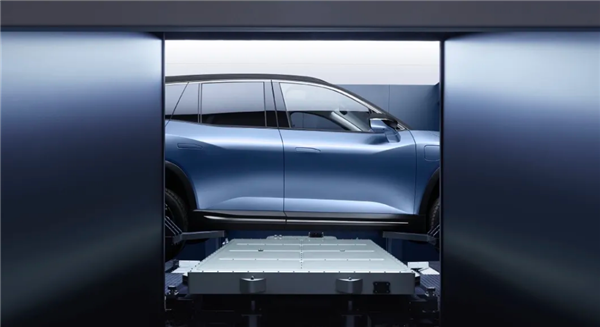

On August 20, Chinese EV startup NIO launched the Battery as a Service (the “BaaS”) subscription model, which allows users to purchase electric vehicles and subscribe the usage of battery packs separately.

At the same time, NIO announced the establishment of Wuhan Weineng Battery Asset Co.,Ltd., which will take charge of the newly-launched BaaS business. Aside from NIO, Wuhan Weineng also has another three shareholders, including the Chinese power battery giant CATL, which holds 25% of equity stake.

Providing the BaaS model will conduce to three advantages. First, it will lower the prices for buying a BEV. According to NIO, if users opt to purchase an ES8, ES6 or EC6 model and subscribe to use the 70kWh battery pack under the BaaS model, they can buy the vehicle with a 70,000 yuan ($10,116) deduction off the original price and pay a monthly fee of 980 yuan ($142) for the battery pack. Meanwhile, the users will continue to enjoy the existing favorable policies such as vehicle purchase tax exemption and governmental cash handouts to NEVs.

Wuhan Weineng is founded to own batteries and lease them. As for why some consumers are reluctant to buy BEVs, one of the most common factors is that a BEV costs more than a comparable fuel-burning car, even though the electricity to run is cheaper than oil fuel. The introduction of the leasing model will make an all-electric vehicle more cost competitive, while the battery rental service is similarly priced to that of gasoline refueling.

Another advantage is about the battery itself. Using the BaaS model, the vehicles can be powered by batteries with increasingly greater performance thanks to the incessant upgrades in battery technologies. Besides, a battery swap needs shorter time than that of an EV charging.

In the eyes of some industry insiders, BaaS' significance to the industry is even greater than to the users. “You can never imagine how many difficulties NIO is confronted with in pushing ahead with battery swapping deployment, which has recorded numerous failure cases outside China. What impresses me is that China's battery swap business is being led and promoted by an EV startup rather than many traditional automakers,” said DannyData, a renowned uploader at the video streaming website BiliBili.

Chinese government is supportive of battery swapping model. In May, the “battery swapping station” was officially written into the Report on the Work of the Government as an important part of new infrastructure construction.

China will step up efforts to advance the construction of battery swap infrastructure in the latest move to promote quality growth of the new-energy vehicle (NEV) sector, Xin Guobin, vice minister of MIIT, told a press conference on July 23. The battery swap mode will be piloted in regions including Beijing and Hainan, Xin added.

Among traditional OEMs, BAIC BJEV is at the forefront in developing battery swapping model. According to a framework agreement signed by BAIC Group and State Grid Electric Vehicle Service Co., Ltd. (called “State Grid EV” for short) on July 27, BAIC BJEV and State Grid EV will continue their in-depth collaboration on battery swapping business, with the aim of jointly setting up 100 battery swapping stations and serving not fewer than 10,000 vehicles powered by swappable batteries before June 2021.

After multi-year endeavors, BAIC Group has so far deployed nearly 20,000 taxis equipped with swappable battery pack, according to Xu Heyi, former chairman of BAIC Group. He said, under the cooperation with State Grid EV, both parties will leverage their respective advantages to launch the business model combining the sale of vehicles without batteries and the battery rental service on mass scale, which is unprecedented in China.

Nevertheless, the high costs in constructing battery swapping stations, the lack of uniform standards and the difficulty in making profits were all snags ahead of a wider adoption of battery swapping model. Thus, automakers or operators usually tap the business from a trial operation in taxi or ride-hailing service areas.

“The early-stage investment in charging infrastructure construction is basically for asset-heavy businesses, so it is quite difficult to make profits at an initial stage,” said Tong Zongqi, director of Information Department of China Electric Vehicle Charging Infrastructure. He considered that the profitability model will become increasingly mature with the charging operation ripening day by day.